How I Protected My Future When Love Came Knocking the Second Time

What happens when love finds you again, but your finances are no longer just your own? I’ve been there—juggling emotions, commitments, and real financial risks after remarrying. One wrong move could’ve cost me everything I’d built. That’s why I took control. This is not about distrust; it’s about clarity. In this article, I’ll walk you through the practical steps I used to protect assets, align expectations, and build a secure financial future—without killing the romance. It’s not about expecting the relationship to fail. It’s about ensuring it has the best chance to succeed, with both hearts and finances in alignment. For many women in their 30s to 55s, especially those raising children or managing households, financial security is deeply tied to peace of mind. When love returns, it should bring joy—not uncertainty.

The Emotional Crossroads: When Love Meets Financial Reality

Remarriage often arrives with a sense of renewal. It brings companionship, emotional healing, and the promise of shared joy. But for many, especially those who have built lives independently, it also brings a complex web of financial responsibilities. Unlike a first marriage, where finances may start from a clean slate, second marriages typically involve assets accumulated over years, retirement accounts, home equity, debts, and often, children from previous relationships. These realities don’t diminish love—they simply add layers that require thoughtful navigation. Ignoring them doesn’t protect the relationship; it risks undermining it.

Emotions can cloud judgment, especially when trust and affection are growing. Many women in second relationships hesitate to bring up money, fearing it will be seen as cold, calculating, or a sign of mistrust. But the truth is, avoiding financial conversations doesn’t preserve romance—it creates fertile ground for future conflict. Unspoken assumptions about spending, saving, or inheritance can lead to resentment. For example, one partner may assume their home will naturally pass to their children, while the other expects it to be shared equally. Without discussion, these expectations remain invisible until they collide.

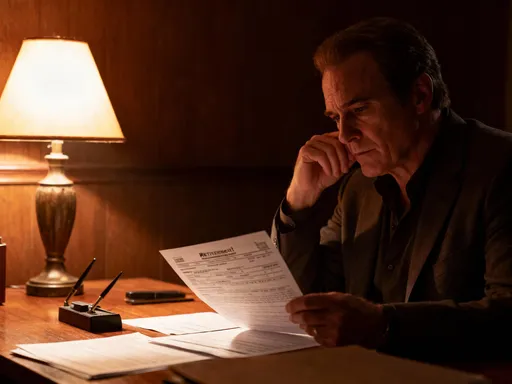

Consider a scenario: a woman in her early 50s remarries after being widowed. She owns a home outright and has a modest retirement fund meant to support her and her teenage daughter. Her new husband, though loving, has significant credit card debt and no savings. They merge households, open joint accounts, and over time, her savings are used to cover his expenses. Years later, when health issues arise, she realizes her financial cushion is gone. This isn’t a story of betrayal—it’s a story of unmanaged risk. The emotional weight of such outcomes can be devastating, not just financially but relationally.

The goal isn’t to approach remarriage with suspicion, but with awareness. Recognizing that financial harmony requires intention helps normalize the conversation. It’s not about building walls—it’s about laying a strong foundation. When both partners understand what each brings into the relationship, they can build something lasting, rather than risk losing what they’ve already worked so hard to create.

Why Risk Control Matters More in Second Marriages

Financial risk in second marriages extends beyond daily budgeting. It touches on legacy, autonomy, and long-term stability. While first marriages often focus on building a future together, second marriages frequently involve protecting what has already been built. This shift changes the financial landscape significantly. The stakes are higher because more is at risk—not just income and expenses, but accumulated wealth, retirement security, and promises made to children.

One of the most common vulnerabilities is the loss of control over pre-marital assets. In many jurisdictions, marriage can automatically grant a spouse certain rights to property, even if it was acquired before the relationship began. Without proper safeguards, a home, investment account, or inheritance could become subject to division in the event of divorce or death. This doesn’t mean expecting the relationship to end—but life is unpredictable. Illness, job loss, or changes in circumstances can strain even the strongest bonds. Planning isn’t pessimistic; it’s practical.

Another critical risk is unintended inheritance shifts. Without clear planning, a new spouse may legally inherit a larger share of an estate than intended, potentially leaving children from a prior marriage with less than expected. This isn’t about favoring one family over another—it’s about honoring commitments made over decades. Many women entering second marriages want to ensure their children are protected, especially if those children rely on future support for education or housing. Failing to address this can lead to family conflict down the line, even when love is genuine in the present.

Dependency is another often-overlooked risk. One partner may reduce work hours or leave a job to support the household, only to find themselves financially vulnerable later. This is especially true for women who have managed homes and children for years. While shared responsibility is valuable, losing financial independence can be dangerous if the relationship changes. Risk control isn’t about assigning blame—it’s about ensuring both partners retain dignity and security, no matter what the future holds. Just as you wouldn’t drive without insurance, you shouldn’t enter a second marriage without basic financial protections in place.

Setting the Foundation: Financial Transparency Without Awkwardness

Having honest conversations about money doesn’t have to be uncomfortable. In fact, when approached with care, these discussions can deepen trust and strengthen the relationship. The key is to frame them not as investigations, but as collaborations. Instead of asking, “What’s your debt?” try, “Let’s both share where we stand so we can plan our future together.” This shift in language makes the conversation about partnership, not scrutiny.

A practical way to begin is by creating a shared financial summary. Each partner can prepare a simple document listing assets, debts, income, and major financial goals. This isn’t about handing over bank statements—it’s about transparency. For example, one person might list a home valued at a certain amount, a retirement account, and student loan debt. The other might note a car loan and a desire to travel in retirement. Seeing these details side by side helps both partners understand the full picture.

Timing matters. These conversations should happen well before the wedding, ideally during the engagement period. Waiting until after legal ties are formed can make discussions feel like accusations. Starting early allows both people to ask questions, express concerns, and explore solutions together. It’s also important to keep the dialogue ongoing. Finances change—bonuses, job shifts, medical costs—and regular check-ins help maintain alignment.

Another helpful approach is to focus on shared goals. Instead of dwelling on past mistakes, talk about the future. “We both want to feel secure in retirement” or “We’d like to support our kids through college” are unifying statements. From there, it’s easier to discuss how current finances support those goals. If one partner has high debt, the conversation can shift to, “How can we work together to reduce this so we both feel more stable?” This turns money from a source of tension into a shared project.

For many women, especially those who have managed household budgets for years, this level of openness may feel natural. But it’s important not to assume responsibility for the other’s finances. Equality doesn’t mean one person takes over—it means both participate. Using neutral language, active listening, and patience can transform what might seem like a difficult talk into a meaningful step toward unity.

Smart Legal Moves That Actually Work (And Won’t Ruin the Vibe)

Legal agreements like prenuptial and postnuptial contracts are often misunderstood. Many see them as unromantic or a sign of doubt. But in reality, they are tools for clarity and fairness. A prenuptial agreement isn’t about planning for divorce—it’s about defining how assets will be handled during the marriage and in the event of separation or death. For women with children from a previous relationship, this can be a way to ensure those children are not unintentionally disinherited.

Starting the conversation requires sensitivity. Instead of saying, “We need a prenup,” try, “I’ve been reading about how couples protect their families when remarrying. Would you be open to learning more about it together?” This invites collaboration rather than demand. It’s also wise to suggest that both partners have independent legal counsel. This ensures fairness and prevents one person from feeling pressured. The goal is not to protect against each other, but to protect the relationship from future stress.

Postnuptial agreements serve a similar purpose but are created after marriage. They can be useful if the topic wasn’t addressed earlier or if financial circumstances change—such as receiving an inheritance or selling a business. Like prenups, they require open dialogue and mutual consent. When done correctly, they reinforce trust by showing that both partners are committed to transparency.

Beyond marriage agreements, other legal steps are equally important. Updating beneficiary designations on retirement accounts, life insurance policies, and bank accounts ensures that assets go to the intended people. Too often, old designations from a previous marriage remain in place, leading to unintended outcomes. Trusts are another valuable tool, especially for those with significant assets or complex family structures. A trust can specify that a spouse receives income from an estate during their lifetime, while the principal eventually passes to children. This balances care for both the current partner and future generations.

These tools aren’t about building walls—they’re about creating clear pathways. When both partners understand the plan, there’s less room for confusion or conflict. Far from damaging romance, they can deepen security and trust, allowing love to grow in a stable environment.

Managing Joint Finances Without Losing Individual Control

How couples manage money together can make or break financial harmony. The challenge is to balance unity with independence. One common approach is the three-account system: two individual accounts and one joint account. Each partner contributes to the joint account based on their income, and it’s used for shared expenses like rent, groceries, and utilities. Personal spending—clothes, hobbies, gifts—comes from individual accounts. This model respects autonomy while supporting partnership.

Contributions to the joint account don’t have to be equal. A fairer method is proportional sharing, where each person pays a percentage of their income. For example, if one earns $60,000 and the other $40,000, the first might contribute 60% of the shared expenses, the second 40%. This ensures that financial burden is balanced relative to earning power, which is especially important when incomes differ significantly.

Setting spending limits for larger purchases can also prevent tension. Agreeing in advance that any expense over a certain amount—say, $500—requires a discussion helps avoid surprises. This isn’t about control; it’s about respect. It allows both partners to feel involved in major decisions without micromanaging daily choices.

Maintaining separate credit histories is another key consideration. Even in marriage, keeping individual credit accounts helps preserve financial independence. If one partner has lower credit, the other can still qualify for loans or favorable rates. It also protects both in case of future separation. Emergency access to funds is equally important. Each person should have a personal savings buffer and access to cash, so neither is financially trapped in a difficult situation.

Regular financial check-ins—monthly or quarterly—help keep the system working. These meetings don’t need to be formal. Over coffee, couples can review budgets, discuss upcoming expenses, and adjust contributions if needed. The goal is to make money a normal part of the relationship, not a source of stress. When both partners feel heard and respected, financial management becomes a shared strength.

Protecting Your Legacy: Kids, Inheritance, and Long-Term Wishes

For many women, ensuring their children’s future is a top priority. This doesn’t change with remarriage—but it does require thoughtful planning. Without clear intentions, well-meaning actions can lead to unintended consequences. For example, adding a new spouse to a bank account with rights of survivorship might seem like a gesture of trust, but it could override a will and leave children with nothing. Similarly, failing to update a will after remarriage can result in assets going entirely to the new spouse, even if that wasn’t the original plan.

Life insurance is a powerful tool in this context. A policy can provide direct financial support to children, regardless of what happens to other assets. Payable-on-death (POD) accounts are another simple option. These allow funds to transfer directly to named beneficiaries without going through probate, ensuring faster access. Both tools offer clarity and speed when they’re needed most.

Trusts offer even greater control. A revocable living trust, for instance, can outline exactly how assets should be distributed. It can specify that a spouse receives income from investments during their lifetime, while the principal passes to children upon the spouse’s death. This honors both relationships without forcing a choice between them. Trusts can also protect assets from creditors or long-term care costs, adding another layer of security.

Communication is essential. While legal documents are important, so is talking to both your spouse and your children about your intentions. This isn’t about sharing every detail—it’s about ensuring everyone understands the plan. For children, this can prevent feelings of exclusion. For the spouse, it builds trust by showing that their role is valued within the larger framework. These conversations should be handled with care, focusing on love and responsibility rather than money alone.

The goal isn’t secrecy or favoritism—it’s fairness. By planning thoughtfully, women can honor their past commitments while fully embracing their new relationship. This balance isn’t easy, but it’s possible with the right tools and open dialogue.

Building a Shared Future Without Sacrificing Security

Financial planning in a second marriage isn’t just about protection—it’s about creating space for growth. When risks are managed, couples can focus on shared goals with confidence. This might include saving for a vacation home, supporting adult children, or planning an active retirement. With clear systems in place, money becomes a tool for unity rather than a source of tension.

Aligning investment styles is one way to strengthen this partnership. One partner may prefer conservative savings, while the other is more comfortable with market investments. Discussing these differences openly can lead to a balanced portfolio that respects both comfort levels. Working with a financial advisor together can also help ensure decisions are made as a team.

Retirement planning takes on new dimensions in second marriages. Couples may have different retirement ages, health needs, or lifestyle goals. Mapping out these expectations early allows for realistic planning. Will one partner continue working? How will healthcare costs be managed? These questions are easier to answer when discussed in calm, thoughtful moments rather than under pressure.

Supporting each other’s financial well-being is another hallmark of a strong second marriage. This might mean helping a partner pay off debt, encouraging continued education, or simply respecting each other’s financial boundaries. When both people feel secure, they’re more likely to contribute positively to the relationship. Love thrives when there’s no hidden anxiety about money.

In the end, smart financial planning isn’t cold or calculating—it’s deeply caring. It shows respect for both your own journey and your partner’s. It honors the past while building a future together. For women navigating the joys and complexities of second love, taking control of finances isn’t a barrier to romance. It’s the foundation for a lasting, secure, and truly fulfilling relationship. When love knocks the second time, you don’t have to choose between heart and prudence. With the right steps, you can welcome both.